Seagate can start volume shipping HAMR drives after receiving qualification from a leading cloud service provider and other high-capacity drive customers.

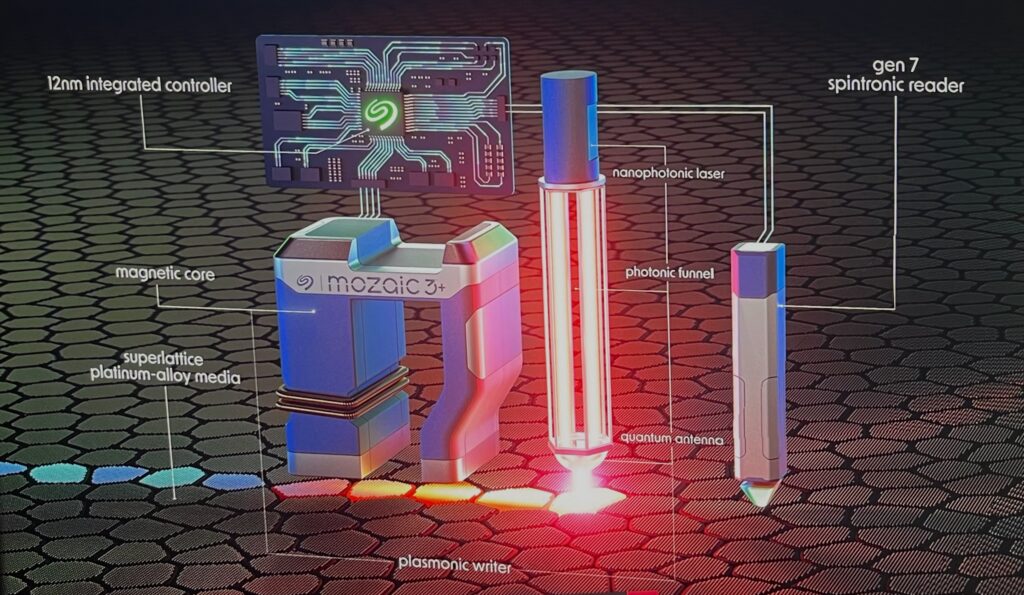

Its Mozaic 3 3 TB/platter heat-assisted magnetic recording (HAMR) technology is so different from conventional perpendicular magnetic recording (PMR) disk drives – with increased areal density, new magnetic recording media, and laser bit spot heating and cooling – that large-scale customers needed to qualify the drives to make sure they worked successfully and reliably. This has taken time, extended by a failure with an externally sourced, mechanical component in spring.

At that time, Seagate had gained HAMR drive qualification from just one high-end, non-CSP customer. Eight months later, it has “successfully completed qualification testing for its HAMR-based Mozaic drives with several customers within the Mass Capacity markets, including a leading cloud service provider.” We might take that term to mean AWS, Azure, or Google Cloud.

This information comes from a Seagate SEC 8K filing, which also says that Seagate faced problems bringing mothballed production equipment back online as the disk drive market climbed out of its slump. Disk drive output in Seagate’s third fiscal 2025 quarter, ending March 28, “will be lower than previously expected with an associated revenue impact of up to $200 million” for the quarter.

Revenues and profitability for the second fiscal 2025 quarter, ending December 27, are “currently trending in accordance with management’s expectations” and are not affected by this production problem.

Wedbush analyst Matt Bryson told subscribers: “As we’ve noted before, if STX (Seagate) executes on its HAMR programs, the company should significantly outperform with its 40-plus TB platform (expected 2HCY’25) in light of its areal density advantage. We see any CQ1/FQ3 shortfall in shipments as a non-concern given the benefits from continued tight industry supply (in our view) outweigh any short-term impact on revenue.”

The 40-plus TB drives are gen 2 HAMR technology and their qualification should proceed more quickly than the multi-month gen 1 qualification period.

Bryson has previously said, referring to mid-2025: “If STX can ramp HAMR around mid-year (and then deliver 40-plus TB Mozaic 4+ drives before year end), the company would seem to be set to transition seamlessly from peak industry conditions into a substantial capacity leadership position vis-à-vis peers,” meaning Western Digital and Toshiba with a consequent rise in market share.

Both WD and Toshiba can expect extended HAMR drive qualification periods when they introduce the technology.

中文 (中国)

中文 (中国) Русский

Русский